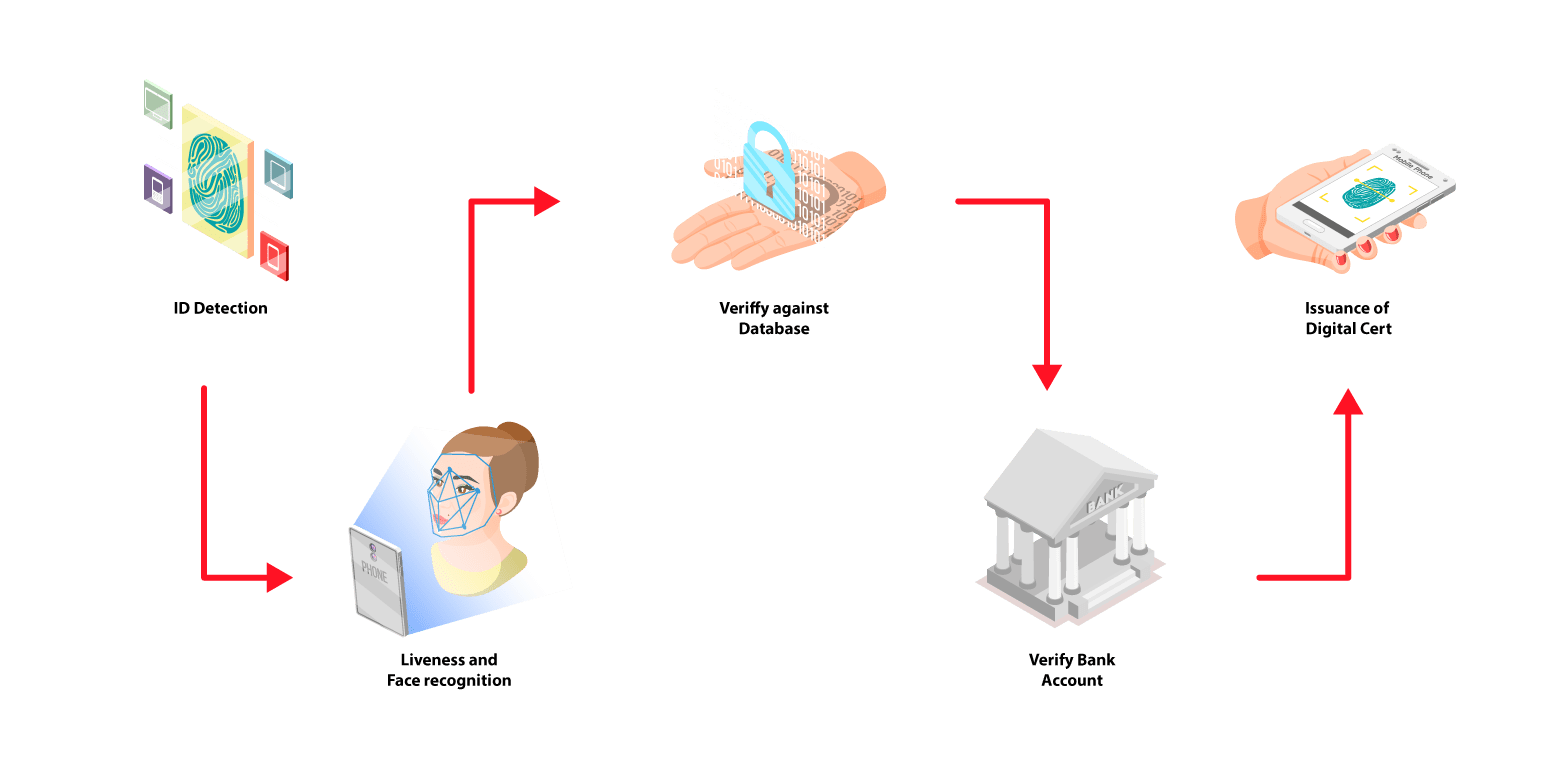

Electronic Know Your Customers onboarding made easy with MyTrust ID. MyTrust ID is a mobile application that allows your customer to have a verified and secure digital identity (ID) required for the eKYC onboarding process. The verification process of MyTrust ID combines 4-layer authentication process involving ID detection, phone number, database and bank account verification before issuing a Digital Certificate.

Some quick example text to build on the card title and make up the bulk of the card's content.

Easy and convenient onboarding process with the ability to perform anytime and anywhere.

Full compliance with regulatory policies.

Reduce decision-making time.

Improve quality of customer service.

Improve operational efficiency and scalability

Embed e-signing functionality to your business processes and applications using our open API.

Customer capture the front and back image of Mykad or front image of Pasport. The Optical Character Recognition (OCR) function will detect details including full name, ID numbers, etc. The system will then identify pre-defined visual landmarks are meeting expected standards.

Verification of the mobile number is done via a SMS One-time Password (OTP).

Verification of the name and Mykad number is done by checking against our own database - verified based on the digital certificates issued over the years.

Verification of a customer's bank account is done via Financial Processing Exchange (FPX). From FPX, we can identify the payee from any successful transfer and matches it with the name of the applicant.